What Does Feie Calculator Do?

Table of ContentsHow Feie Calculator can Save You Time, Stress, and Money.Feie Calculator - TruthsNot known Incorrect Statements About Feie Calculator Not known Facts About Feie CalculatorOur Feie Calculator IdeasThe Feie Calculator IdeasThe 8-Minute Rule for Feie Calculator

If he 'd often traveled, he would rather finish Part III, listing the 12-month duration he fulfilled the Physical Existence Test and his travel background - Form 2555. Step 3: Reporting Foreign Income (Part IV): Mark made 4,500 each month (54,000 each year). He enters this under "Foreign Earned Revenue." If his employer-provided housing, its value is likewise included.Mark determines the exchange rate (e.g., 1 EUR = 1.10 USD) and transforms his salary (54,000 1.10 = $59,400). Since he stayed in Germany all year, the percentage of time he stayed abroad during the tax obligation is 100% and he goes into $59,400 as his FEIE. Finally, Mark reports complete salaries on his Form 1040 and enters the FEIE as an adverse quantity on Schedule 1, Line 8d, minimizing his taxable earnings.

Choosing the FEIE when it's not the best alternative: The FEIE might not be excellent if you have a high unearned earnings, gain even more than the exemption limit, or live in a high-tax country where the Foreign Tax Credit Score (FTC) may be much more valuable. The Foreign Tax Obligation Credit History (FTC) is a tax obligation reduction technique often made use of together with the FEIE.

Feie Calculator Fundamentals Explained

deportees to offset their U.S. tax obligation financial debt with international income tax obligations paid on a dollar-for-dollar decrease basis. This means that in high-tax countries, the FTC can commonly remove united state tax obligation financial obligation completely. Nonetheless, the FTC has restrictions on eligible tax obligations and the optimum case quantity: Qualified tax obligations: Only revenue tax obligations (or tax obligations in lieu of revenue tax obligations) paid to international federal governments are eligible.

tax responsibility on your foreign income. If the foreign taxes you paid surpass this limit, the excess international tax obligation can typically be continued for up to ten years or lugged back one year (through a modified return). Maintaining exact documents of foreign revenue and taxes paid is therefore crucial to computing the appropriate FTC and keeping tax compliance.

migrants to reduce their tax responsibilities. If a United state taxpayer has $250,000 in foreign-earned income, they can leave out up to $130,000 making use of the FEIE (2025 ). The remaining $120,000 might after that be subject to taxation, yet the U.S. taxpayer can potentially use the Foreign Tax obligation Credit scores to balance out the tax obligations paid to the international country.

Some Ideas on Feie Calculator You Need To Know

He sold his U.S. home to develop his intent to live abroad completely and applied for a Mexican residency visa with his better half to help satisfy the Bona Fide Residency Test. In addition, Neil secured a long-lasting home lease in Mexico, with strategies to at some point buy a residential property. "I currently have a six-month lease on a residence in Mexico that I can prolong an additional 6 months, with the objective to get a home down there." Nevertheless, Neil explains that acquiring building abroad can be challenging without very first experiencing the location.

"We'll certainly be beyond that. Even if we return to the US for medical professional's appointments or organization phone calls, I doubt we'll invest greater than one month in the US in any offered 12-month duration." Neil highlights the relevance of strict monitoring of united state brows through. "It's something that individuals need to be truly persistent regarding," he says, and encourages deportees to be cautious of typical blunders, such as overstaying in the U.S.

Neil takes care to stress and anxiety to U.S. tax obligation authorities that "I'm not conducting any type of organization in Illinois. It's just a mailing address." Lewis Chessis is a tax obligation advisor on the Harness system with substantial experience helping U.S. citizens navigate the often-confusing world of international tax obligation compliance. Among the most common misunderstandings among united state

6 Easy Facts About Feie Calculator Shown

income tax return. "The Foreign Tax obligation Credit score enables individuals operating in high-tax countries like the UK to counter their U.S. tax obligation liability by the amount they have actually already paid in taxes abroad," claims Lewis. This guarantees that deportees are not taxed twice on the exact same earnings. Nonetheless, those in low- or no-tax countries, such as the UAE or Singapore, face added hurdles.

The possibility of lower living expenses can be appealing, yet it typically includes trade-offs that aren't quickly evident - https://www.pubpub.org/user/feie-calculator. Real estate, for instance, can be a lot more inexpensive in some countries, yet this can mean jeopardizing on facilities, safety and security, or accessibility to reputable utilities and services. Inexpensive residential properties may be located in areas with inconsistent web, restricted mass transit, or unstable medical care facilitiesfactors that can significantly impact your daily life

Below are a few of one of the most regularly asked inquiries concerning the FEIE and various other exemptions The International Earned Revenue Exclusion (FEIE) enables united state taxpayers to omit as much as $130,000 of foreign-earned revenue from government revenue tax obligation, reducing their U.S. tax obligation responsibility. To receive FEIE, you must meet either the Physical Presence Examination (330 days abroad) or the Authentic House Examination (confirm your key house in an international nation for a whole tax obligation year).

The Physical Visibility Test likewise calls for U.S. taxpayers to have both a foreign earnings and an international tax home.

7 Easy Facts About Feie Calculator Shown

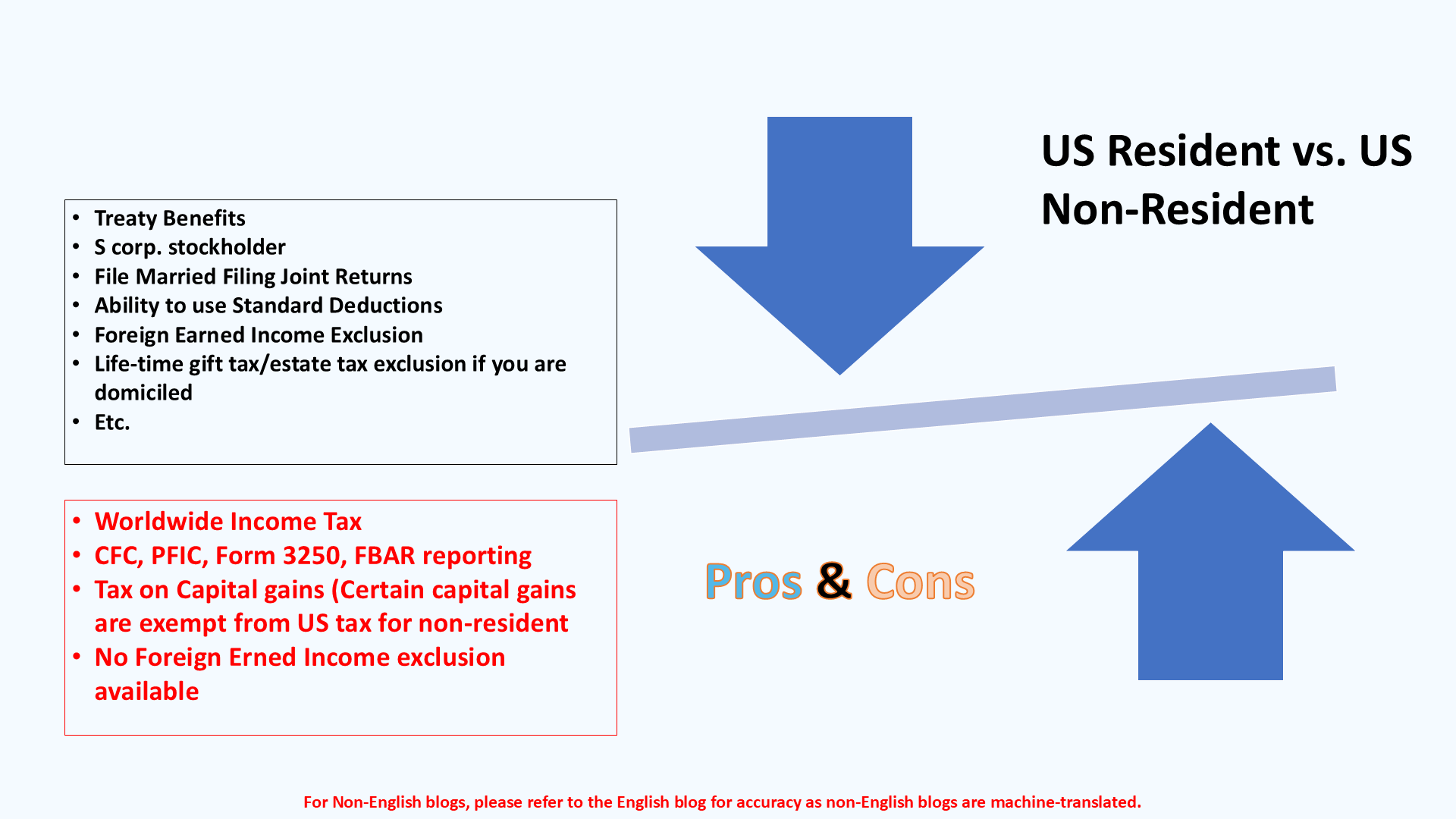

A revenue tax treaty in between the united state and an additional nation can aid protect against double taxes. While the Foreign Earned Income Exclusion reduces taxable click for more info earnings, a treaty may supply fringe benefits for qualified taxpayers abroad. FBAR (Foreign Savings Account Report) is a needed declaring for U.S. residents with over $10,000 in international economic accounts.

The international made income exclusions, occasionally described as the Sec. 911 exclusions, leave out tax on salaries earned from working abroad. The exemptions consist of 2 parts - an earnings exemption and a real estate exemption. The following FAQs go over the benefit of the exemptions including when both partners are deportees in a basic way.

The 4-Minute Rule for Feie Calculator

The earnings exclusion is currently indexed for rising cost of living. The optimal yearly earnings exclusion is $130,000 for 2025. The tax obligation advantage omits the income from tax obligation at lower tax rates. Formerly, the exemptions "came off the top" lowering earnings subject to tax at the leading tax rates. The exemptions may or might not minimize income made use of for various other functions, such as IRA restrictions, kid credit scores, personal exceptions, etc.

These exemptions do not excuse the wages from United States taxation however simply offer a tax obligation reduction. Keep in mind that a single individual working abroad for all of 2025 that made about $145,000 without other income will certainly have gross income decreased to no - properly the very same solution as being "free of tax." The exemptions are computed on a day-to-day basis.

If you attended service conferences or workshops in the United States while living abroad, income for those days can not be excluded. For US tax it does not matter where you maintain your funds - you are taxed on your globally income as a United States individual.